How Wall Street Became Washington’s Favorite Partner

A Columbia PhD candidate and recipient of the Center for Political Economy 2025 grant for graduate students explores the roots of Wall Street’s power in America.

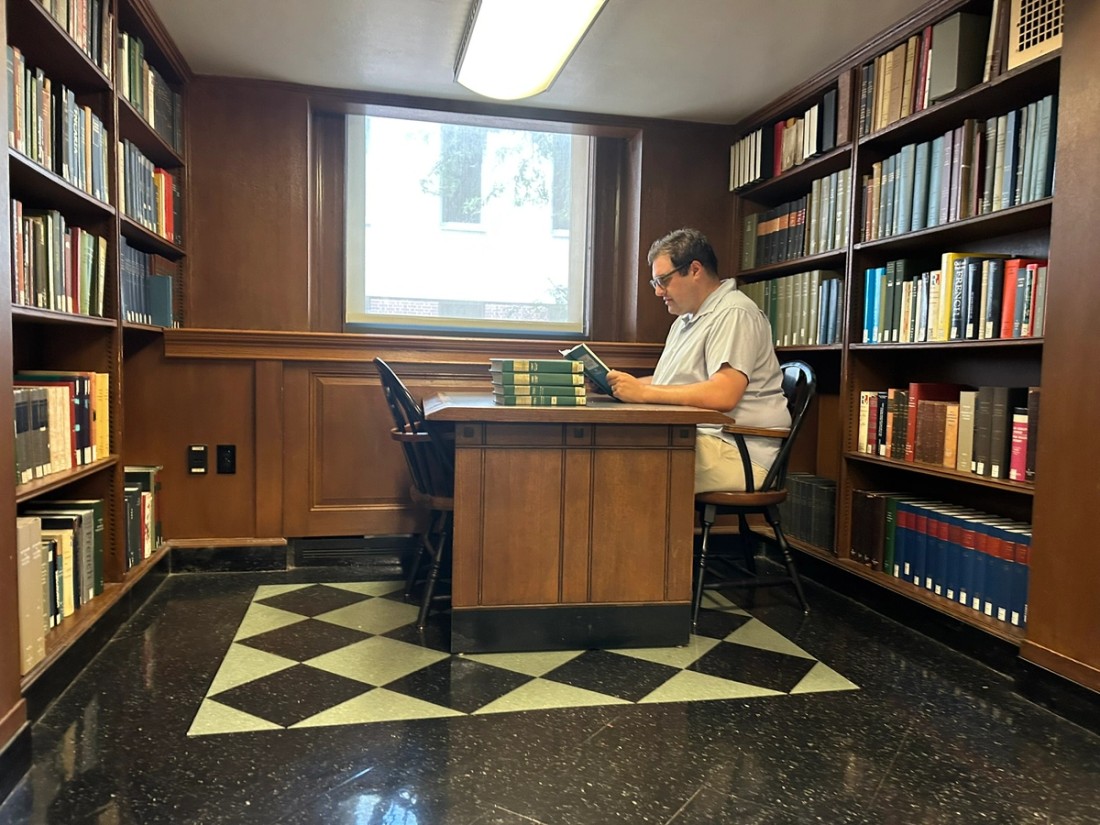

When Lehman Brothers collapsed in 2008, Aaron Freedman was 16 years old — old enough to notice the adults around him were panicking. “I remember seeing people carrying boxes out of their offices in Times Square,” he says. “I didn’t yet understand what was happening, but I knew it was going to change everything.” Now a Columbia History PhD candidate, Freedman is asking a question with major implications for today’s economy: How did Wall Street become the center of American economic life, and why did policymakers let it happen?

Freedman’s dissertation traces the rise of modern Wall Street from the 1970s through the 1990s—a period when the U.S. economy was rocked by inflation, deregulation, and deep political change. He also explores how policymakers like Federal Reserve Chair Paul Volcker and Treasury Secretary Don Regan transformed Wall Street from a relatively sleepy, clubby world, disconnected from the day-to-day life of most Americans, into a full-blown partner in economic governance. “We often talk about deregulation,” Freedman says, “but I’m looking at how government institutions actively nurtured Wall Street—not just removed guardrails, but made it central to the economy, something that affects all of us whether we like it or not.” Drawing from archival research at the Reagan Presidential Library, the Lehman Brothers papers, and other sources that have recently opened to the public, his work shows how political ideology, crises, and financial innovation converged to create what he calls the “securities state.”

Freedman’s work is especially timely as we consider the headlines about various economic levers being considered by policy makers and politicians alike in managing the economy. Understanding how political leaders once chose—consciously or not—to make Wall Street their partner in ensuring economic growth, according to Freedman, we can better understand both the persistence of financial power and the difficulty of reform. “Wall Street’s role isn’t just about markets,” he says. “It’s about legitimacy, about how the government tries to deliver economic security without doing it directly.” In an era when student debt, housing access, and climate finance are urgent political questions, his research offers historical insight into how—and why—financial markets became the default tool for public policy.

Aaron Freedman grew up in Morningside Heights, just blocks from Columbia, in a household steeped in civic life — his father a journalist, his mother a lawyer for City Hall. “My parents basically asked questions for a living, and they raised me to do the same, to question power and the idea that things are naturally supposed to be a certain way.”

That mentality followed him through college, where he majored in history at Swarthmore and later worked in economic policy communications. “Communications taught me how to explain ideas. But history gave me the tools to understand them.” At Columbia, he says, he found the depth and freedom to investigate those big questions more rigorously.

As one of 30 graduate student grant recipients this year, Freedman credits the Center for Political Economy (CPE) with making his research truly expansive and firsthand. “I’ll be able to visit archives in California and Texas, talk with former policymakers, and connect with other scholars working on finance and inequality,” he says. Through CPE, he’s also found a growing intellectual community at Columbia that bridges history, law, economics, and political science. “There’s a lot of appetite for asking the big questions again—about power, capital, and governance.” The grant, he adds, “isn’t just about money. It’s about saying: this work matters.”

“If we want a different economic future,” Freedman says, “we need to understand how we got here—and who made the decisions that shaped that path.” His research may be historical, but the implications are all around us.

About the Center for Political Economy at Columbia University

The Center for Political Economy (CPE) is reimagining the relationship between markets, governments, and people. It supports research that challenges orthodoxies and equips scholars to interrogate capitalism’s structures, logics, and impacts across time and place. By fostering collaboration across disciplines—from history and law to economics and political science—CPE is building the intellectual foundations for a more democratic and equitable political economy.

In 2025, CPE awarded its second cohort of Graduate Student Grants to 30 Columbia doctoral students working on urgent questions in political economy, from climate risk and global supply chains to misinformation and financialization. These one-year grants support archival research, fieldwork, data analysis, and academic convenings—expanding the space for bold, rigorous, and interdisciplinary scholarship on the systems that shape economic life.